- Início

- Euronext Lisboa

Euronext Lisboa

Euronext Lisboa

Índices portugueses

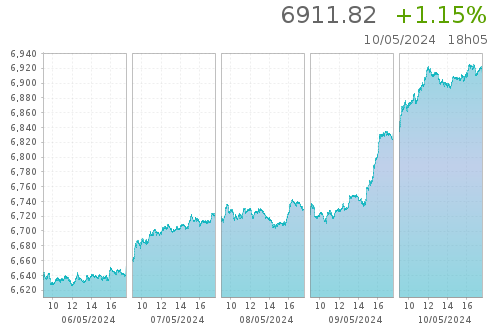

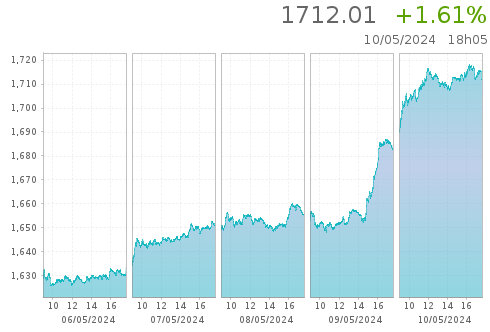

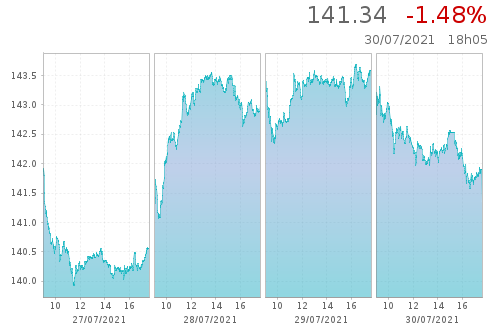

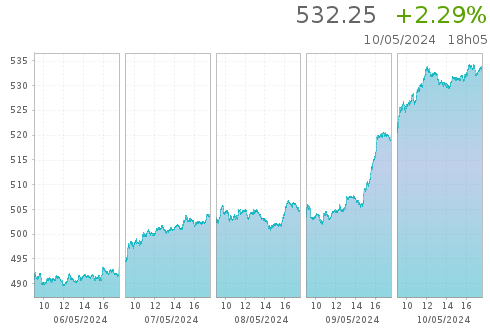

| Índices | Último | % |

|---|---|---|

| PSI | 6 542,23 | +0,19 % |

| PSI ALL-SHARE | 1 602,09 | +0,09 % |

| PSI LEVERAGE | 478,062 | +0,37 % |

| PSI HIGH DIV NR | 141,34 | -1,48 % |

| PSI XBEAR GR | 34,939 | -0,35 % |

Índices EU

| Nome do instrumento | Último preço | Day-change-relative |

|---|---|---|

| EURONEXT 100 | 1 504,93 | -0,72 % |

| CLIMATE EUROPE | 1 900,84 | -0,31 % |

| LOW CARBON 100 | 161,34 | -0,17 % |

| NEXT BIOTECH | 2 062,85 | -1,34 % |

| ESG 80 | 2 047,40 | -0,88 % |

Câmbio

| Nome do instrumento | Último preço | Day-change-relative |

|---|---|---|

| EUR / USD | 1,07295 | +0,28 % |

| EUR / GBP | 0,85765 | -0,10 % |

| EUR / JPY | 166,9415 | +0,52 % |

| EUR / CHF | 0,97870 | -0,01 % |

| GBP / USD | 1,25113 | +0,40 % |

Mercados a contado

Comunicados empresas

MAIS SOBRE A EURONEXT LISBON

Saiba mais sobre os mercados Euronext

Visite a página sobre o mercado português e saiba mais sobre a praça de eleição para os emitentes portugueses.